AUGUSTA — The Finance Authority of Maine (FAME) celebrated business and education success stories and partnerships at its annual meeting and awards event, Showcase Maine, on Thursday, November 21, 2024, at South Portland’s Portland Sheraton at Sable Oaks.

Showcase Maine is FAME’s annual celebration of successful partnerships with Maine’s business, lending, governmental, and higher education communities. The event featured a reception, including a showcase of exhibits by Maine businesses and educational organizations that partner with FAME, as well as a dinner and awards presentations.

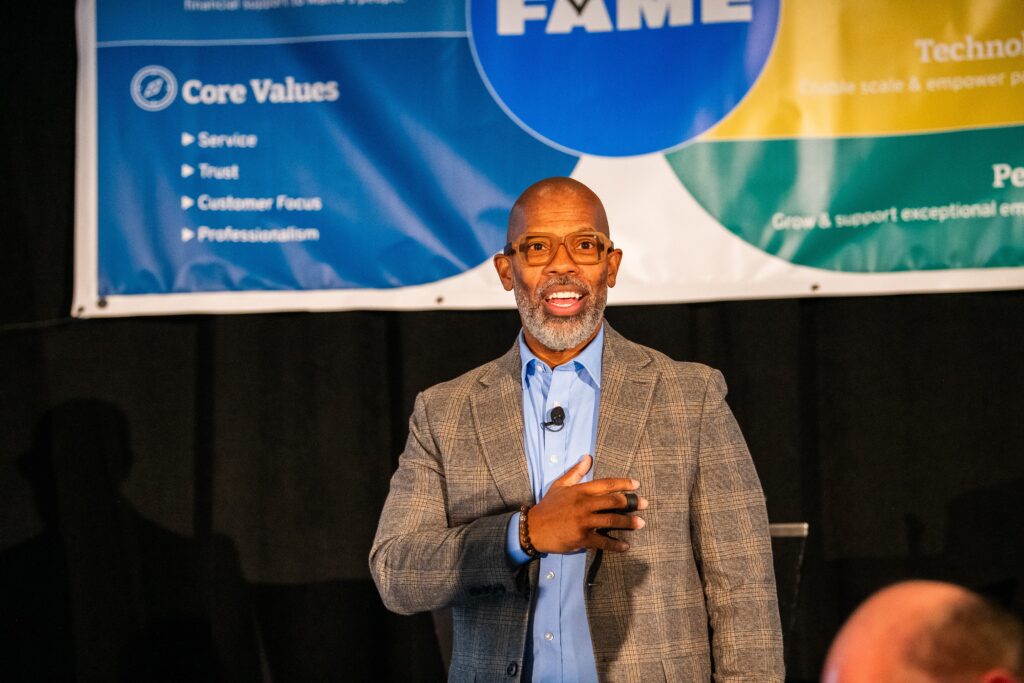

Curtis Hill, a diversity strategist, educator, author, speaker, and trainer, delivered a dynamic and interactive keynote speech. Hill spoke about creating a Culture of Belonging™ in the workplace that maximizes people, profitability, and performance by tapping into what allows team members to bring their full potential to work. Rosemary Crimp, a voice teacher and lyric soprano at River Tree Arts, performed the national anthem, as well.

Martha Johnston, FAME’s Director of Education, emceed the event. In her remarks, Johnston noted that FAME recently completed a new round of planning work to better align its efforts and focus with the hopes and needs of the state going forward. FAME plans to be a key convenor of financing opportunities for FAME citizens and organizations in both the commercial and education arenas. She further took time to celebrate the 25th anniversary of Maine’s 529 Education Savings Plan, NextGen 529®. NextGen 529 is a top ten education savings plan in the nation, with approximately $15 billion in assets under management. Accounts can be set up for any child or grandchild, friend or relative regardless of income, residency, or the age of the beneficiary. FAME incentivizes savings for eligible Maine accounts through its matching grant programs.

This year’s award recipients included:

- Business at Work for Maine Award – Standard Biocarbon, LLC, was honored for their innovative work delivering high-carbon biochar produced by state-of-the-art technology from clean, source-verified biomass harvested from the working forests of Maine. Located in Enfield, the company is a clean-tech startup producing biochar at industrial scale to supply demand in agriculture, remediation, composite materials and to generate carbon removal credits. The company has benefited from a FAME Direct Loan and a Grow Maine/SSBCI loan. The FAME/SSBCI loans were made in partnership with CEI and MTI. The company also has benefited from an MRDA loan. To learn more about the company, please visit Standard Biocarbon

- Education at Work for Maine Award – Worthington Scholarship Foundation was honored for their extraordinary commitment to providing scholarships and support to graduates of Maine public high schools attending Maine colleges. Since its founding in 2010 by Beverly and David Worthington, WSF has awarded hundreds of scholarships to four-year college and two-year college students from all of Maine’s counties. The Foundation has continuously sought to expand and grow in ways designed to support students and their success, including by providing ongoing financial education for their recipients. The Foundation works closely with FAME to understand FAFSA filing and financial eligibility data for Maine students. To learn more about the Foundation, please visit Home – Worthington Scholars

- Lender at Work for Maine Award (over $1.5 billion in assets) – Camden National Bank: This was the bank’s fourteenth time as an awardee. Over the past year, Camden National Bank partnered with FAME on 55 loans totaling approx. $15 million. This helped to create 108 Maine jobs and retain an additional 611 jobs. One notable transaction involved support for A Couple of Koi, LLC, the operating entity for The Hoot restaurant in Northport, a farm-to-table restaurant that sources their produce and meat from local farms. The financing helped to create twelve jobs and retain eight jobs. In addition to being a top partner in stimulating economic development in Maine, Camden National Bank is actively committed to the communities in which it operates. Founded in 1875, the bank encourages employee volunteerism and makes donations to local nonprofits. The bank dedicated this year’s award to longtime (now retired) executive vice president and senior lending officer Timothy Nightingale, who also served on the FAME Board for several years. To learn more about Camden National Bank, please visit Camden National Bank – Banking the Way You Live Today & Tomorrow

- Lender at Work for Maine Award (up to $1.5 billion in assets) – Franklin Savings Bank was honored in the category of lenders with assets under $1.5 billion. This past year, Franklin Savings partnered with FAME on ten loans totaling $4.5 million. This helped to create nine Maine jobs and retain an additional eighty-five jobs. A community bank based in Farmington since 1868, Franklin Savings conducts business primarily in Western and Central Maine, with commercial services offered in Ellsworth. The bank’s mission is to remain a financially strong, independent community bank, dedicated to superior customer and community service. Through its FSB Community Development Foundation, the bank takes pride in its generous support of various causes in the community. To learn more about Franklin Savings Bank, please visit Franklin Savings Bank | Local Banking | Central & Western Maine

- Lender at Work for Maine Award (most enhanced partnership) – Norway Savings Bank was honored for having greatly increased its partnership with FAME on various financing projects. Founded in 1866, Norway Savings is a leading mutual banking and financial services company headquartered in Norway. The bank has a strong commitment to personal, community, and financial values. They are proud to be a community bank known for their financial strength, exceptional customer experience, and contributions to local communities. This past year, FAME partnered with Norway Savings on 16 loans to Maine companies totaling approximately $6 million, an increase of $2 million compared to last year. This helped to create fifty-six Maine jobs and retain an additional 237 jobs. To learn more about Norway Savings Bank, please visit Norway Savings Bank

Prior to the event, the FAME board of directors held its monthly meeting. New officers were elected to one-year terms. Officers elected for 2025 include: Renee Ouellette, President & CEO of University Credit Union (Chair); William Tracy, President & CEO of Auburn Savings Bank (Vice Chair); and Dustin Brooks, Vice President of Marketing Strategy, UNUM Group (Treasurer).

FAME is a quasi-independent state agency whose mission is to enrich business and educational outcomes through relevant, timely financial support to Maine’s people. Our vision is a Maine where all people have access to improved economic outcomes through business growth and education attainment. FAME recently was recognized for the tenth year in a row as one of the Best Places to Work in Maine. To learn more about FAME, please visit www.FAMEmaine.com

Photos by Sharyn Peavey Photography