Tips on Personal Finance Tips

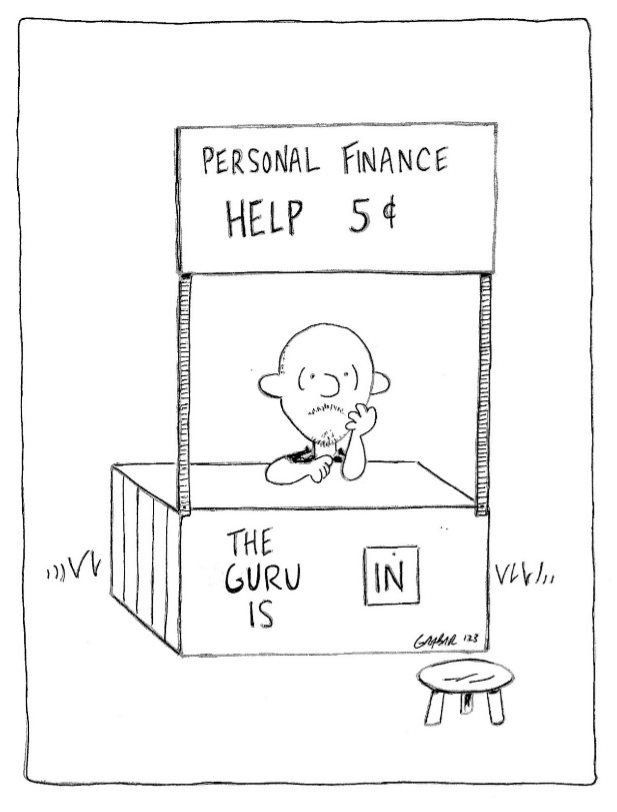

If you Google, “Personal Finance Tips for 2025”, you’ll get 800,000,000 results. Not only did I not read all 800,000,000, but I also didn’t even get through the first eight before I found contradictions. This didn’t really surprise me as I see plenty of tips and tricks from a variety of sources, and, yeah, they are all over the place.

And I recently started following another PFG (personal finance guru), enjoying his takes on money topics as well as his analysis of other advice he has seen on social media. As I was listening to him rant against reckless spending, he went on a budgeting tangent, and he said, “I don’t like budgets, I don’t use budgets, I don’t recommend budgeting to my clients.”

What?!? (needle scratches across the record…) Say it ain’t so! Later, in another video, he comes out against home ownership, saying that he rents and will continue to rent.

Foundations rattled; pillars crumbled. My all-time PFG (Dave Ramsey) would be plugging his ears or unplugging his speakers.

Personal finance is important, and there should be a standard playbook, right? Well, maybe not. While there are some fundamentals that apply almost all the time to almost all individuals, there are also different methods/tools/strategies which push us toward the same result and there are nuances within personal finance subjects which depend on age, income, stage of life, values, and more.

It can be overwhelming to decide which advice is right.

So, at the well-calculated risk of further muddying the waters, I’m offering my tips on sorting through personal finance tips.

A Few Pillars to Lean on

First, let’s cover ground absent of debate, places where respectable PFGs gather in peace.

- Spend less than you make

- Follow the law

- Buyer beware

That’s All?

There are probably more personal finance principles that most would agree on, but the list is (surprisingly?) short. It’s much easier to note where folks don’t agree.

- Coffee will make you poor

- Always save 10%

- Always save 20%

- Rent don’t own

- Own don’t rent

- Pay debt before investing

- Invest as much as possible as soon as possible ignoring debt

- Pay student loans

- Wait for government modifications to student loans & payments

- Don’t buy new cars

- Never buy a used car

- Always use cash

- Credit cards are never a good choice

- Buy term life insurance

- Buy whole life insurance

- Don’t buy life insurance at all

Quoting myself from a few paragraphs ago…

“…there are nuances within personal finance subjects which depend on age, income, stage of life, values, and more.”

This also illustrates the difference between PFGs (personal finance gurus) and CFPs (Certified Financial Planners) and other personal finance professionals (and Certified Personal Finance Educators like me).

PFGs, even when honest and well-meaning, throw out generalizations and statements, and might be trying to attract attention (if they get paid by views and clicks).

CFPs, CPFs, ChFCs, CFEs, etc., take a global look at finances with a holistic approach to charting a path, addressing the details along the way that make the most sense for the person, time, and place.

But This, This is Just Wrong

I just saw a social media marketing post, disguised as financial advice, which lures readers with something like, “Stop Making These Financial Mistakes”. SIX of the eight items on their list included recommendations to BUY something or to BORROW.

I can’t get behind any financial wisdom which advises buying or borrowing. Sometimes, and when I say sometimes, I mean rarely, refinancing can be on the table but might be for situations involving crippling debt or other crises.

Examples of this type of “advice” are not hard to find, you’ve probably seen or heard an ad or post that says the way to improved finances can be found through:

- Home and/or auto warranties

- Another credit card (but this one has a lower introductory interest rate!)

- Invest in real estate (risk free!)

- More life insurance

- Buy cryptocurrencies

- Refinance credit cards (for a fee)

- Buy cheaper insurance (no matter if the coverage is appropriate)

- Get a credit card with bonus miles

- Pay a retail store a membership fee so you can then buy more overpriced toilet paper than a family will need this decade

Some of these sources also imbed (sort of) the idea of shopping around for the best deal on certain items, and that is generally a good idea. However, when they say to shop around but provide you a link to just one company, you are reading an advertisement, not financial advice.

When consuming personal finance articles or posts, consider this: if they are selling, they are not helping.

—–

It’s tricky offering advice on taking personal finance advice. One might think that the numbers don’t lie and that every decision about money is correct if made by applying experience and math. But it doesn’t work that way because the ones applying the experience and the math are people, and no two people see things the same way. So, yes, paying debts off according to interest rate might make mathematical sense, but paying debts off the Dave Ramsey Snowball Way (smallest to largest) can provide a critical psychological boost which can propel someone to greater success than math alone.

After a couple of decades of this, I have established a few unbreakable pillars, but I’m always listening to fresh viewpoints as well. However, for several years now, most “new ways” of mastering money that I’ve seen are at best gimmicky and at worst outright FOMO-driven schemes designed to separate us from our money.

I think it’s probably been this way for as long as there has been money.

So, for those of us who live in the paradox of not having enough money to pay for advice on how to have more money… Keep learning, know yourself, understand your risk tolerance, spend less than you make, and when approached by the latest trend which unlocks money’s mysteries, hold onto your wallet and back away.

Links on PFGs and other types of personal financial advisors.

Types of finance professionals from Enrich

Finally, SNL tells us all we really need to know.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.