Teach Your Children Well (about money)

“Out of college, money spent.

See no future, pay no rent.

All the money’s gone, nowhere to go.”

-The Beatles

Most of the ideas for these posts come from my personal experience with money or from my experiences teaching personal finance. However, inspiration for which topic to cover in a particular month sometimes comes from unexpected sources.

Over the Thanksgiving holiday weekend, I attended a concert – the 22nd Annual Beatles Night concert – delivered by Spencer and the Walrus. (For Beatles fans who have not seen one of these shows… Make plans for Thanksgiving weekend 2025 and the 23rd iteration. It’s a truly incredible experience. I think I’ve been to 15 of the 22 shows.)

I take you to a moment in the concert when the band invited a nine-year-old boy to play drums for “While My Guitar Gently Weeps.” After the song, the crowd went wild. He came to the front of the stage and bowed, drumsticks in hand. HE NAILED IT!

The boy is the son of the band’s drummer, and as he took his bow, his dad climbed back into the seat behind his kit and wiped the happy tears rolling down his face. This was followed by the others in the band (especially the guys) drying their eyes. And if that wasn’t enough, a few songs later the drummer’s young daughter led the theatre in singing “Yellow Submarine.” Are you kidding me?! It was perfect.

And the cobbler’s children have no shoes

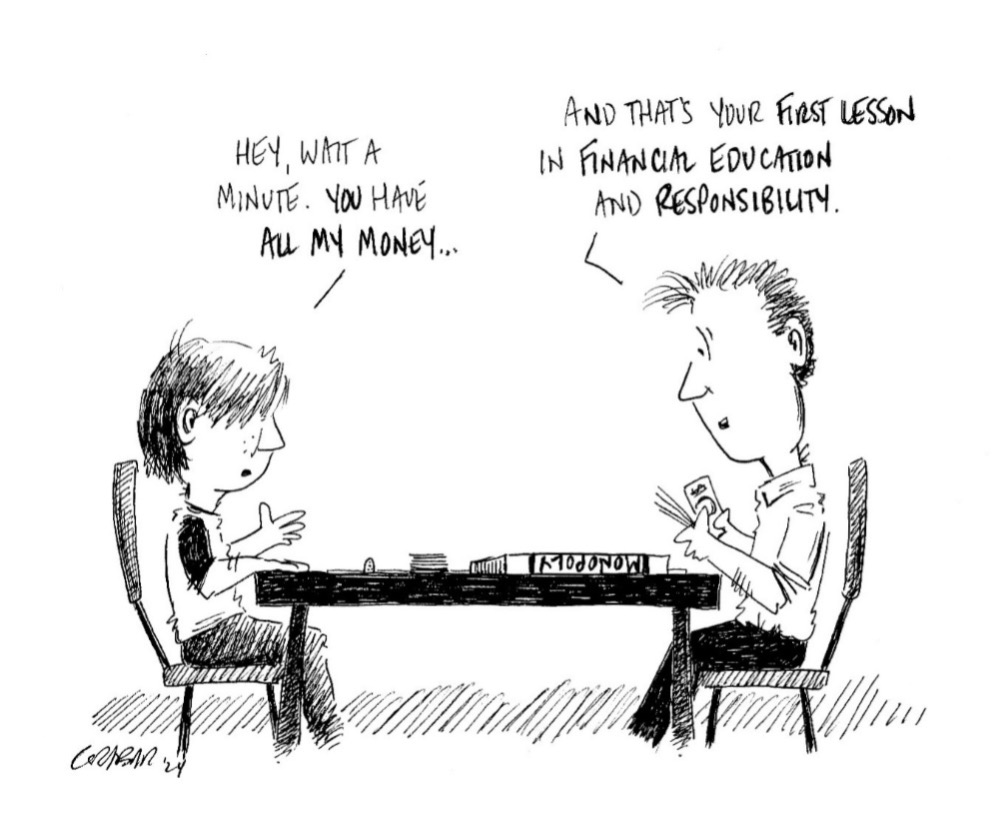

After both of those kids made their dad proud, I looked to my 12-year-old son and said, “You should know that I get emotional any time you say that you are going to save your birthday money rather than buy something.” He laughed ‘cause he knows it’s true.

All joking aside, that moment made me think about what I have passed on to my kid from my profession.

It’s a big conversation, but right now I’ll focus on the part related to that old Spanish proverb about the cobbler. I teach personal finance, but I often wonder if I am teaching my boy enough about money. No matter what we do for a living, we all have had to learn how to manage our finances in a uniquely complicated and unforgiving system. How can we prepare our children to survive and thrive?

While some students in Maine are benefiting from school-based financial education, it is still not available to all. See the end of this post for an update on efforts to guarantee financial education basics for all Maine high school students.

“Children are great imitators. So give them something great to imitate.” —Unknown

There once was a man named Aristotle, who had a lot of things to say about … (darn it, nothing relevant rhymes with Aristotle). Well, he had a lot of things to say about a lot of things, including raising children. He felt that children learn best through imitation. Hmm… that sounds a lot like observing role models, learning by example, etc.

“Parents are the primary influence on a child’s future financial well-being because they have many occasions to communicate information, set powerful examples, and involve children in activities that teach them financial skills. Parental involvement in their children’s financial education has long lasting effects.” – Federal Deposit Insurance Corporation

I’ll add, for whatever it’s worth, that in my now decades of studying and teaching personal finance, I’ve seen no greater influence on kid’s attitudes toward money than what they have learned at home, mostly through watching and listening. And yes, that can be a good thing. But it’s too often not as we adults don’t always exhibit strong and responsible financial behavior. I can only imagine what messages I would have sent if I had children when I was, eh, struggling with my financial decision making.

And even though I think my son is learning positive money lessons through a bit of household osmosis, I know it’s not enough. I must take more proactive, age-appropriate actions to teach him how things work in the U$A. Some of these are done, some in progress, some are coming soon:

- Opening a bank account

- Paying him, if necessary, to read my blog. Hey, that gives me an idea…

- Piggy bank at home

- Looking at the bank account and explaining interest

- Talking about how much of that birthday money to save

- Opening a 529 savings account, making contributions, putting part of his money into the account, showing him how the money has grown, and having regular chats about the costs and benefits of education

- Explaining debit and credit cards while checking out at the grocery store

- Explaining unit price at the grocery store

- Explaining the stock market and letting him manage $100 in an online account

- Taking part in an online course with an essay contest

- Asking his school if they are offering any opportunities for personal finance or economics through class topics, or clubs, guest speakers (like me!), etc.

- Encouraging questions and curiosity about all things money, economics or finance

- Desperate attempts to make opportunity cost seem relevant

Resources, resources, resources

I am a personal finance educator and amateur economist, and I still often find myself saying, “I don’t know how to do that or where to find out.” So, where can we go for help? It’s a long list (of FREE stuff), but don’t try to grab it all at once. Pick one and explore a little at a time. You will find something that works for you and your kid(s). If not, please reach out to me, and I’ll help you dig for something that does work.

- FAME – financial wellness for our kids

- Claim Your Future – FAME’s career and budgeting activity, online version available to everyone, and a classroom kit for teachers & counselors

- iGrad – short courses, articles, videos, and more for high school and college students

- FDIC – teaching children about money

- CFPB – Money as You Grow

- Federal Reserve Bank of St/ Louis – for teachers, a treasure of searchable personal finance and economics lessons and activities

- Next Gen Personal Finance – for middle and high school teachers, complete curricula for personal finance with lessons, activities, and games

- And I (all of us at FAME) like visiting schools in person or virtually, so please don’t hesitate to ask or connect me with someone at your area school to see what personal finance resources we can bring to the classroom.

Update: Maine and Personal Finance Education

I appreciate this forum and the chance to talk about personal finance and lobby for all Maine students to receive financial education. However, I am even more appreciative of the folks who are actively working behind the scenes to make that happen.

Here is the latest from Samantha Drost, Vice President and Conference Coordinator of the Maine Jump$tart Coalition for Personal Financial Education, and Consumer Economics and History teacher at Caribou HS.

“Our second round of presenting the MLR social studies standards to the Education Committee is underway, and the public comment period has now closed. Maine Jump$tart proudly served as a stakeholder on the Overview Team, where we proposed enhanced personal finance standards that we believe will make a significant impact. If approved, the updated MLR social studies standards will align with the six main overarching standard topics set by the National Jump$tart Coalition for Personal Finance Education. The formal review process by the committee is scheduled to begin in January, with a decision hopefully expected by May. Maine Jump$tart remains hopeful and continues to advocate for comprehensive personal finance education for students from kindergarten through high school.”

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.