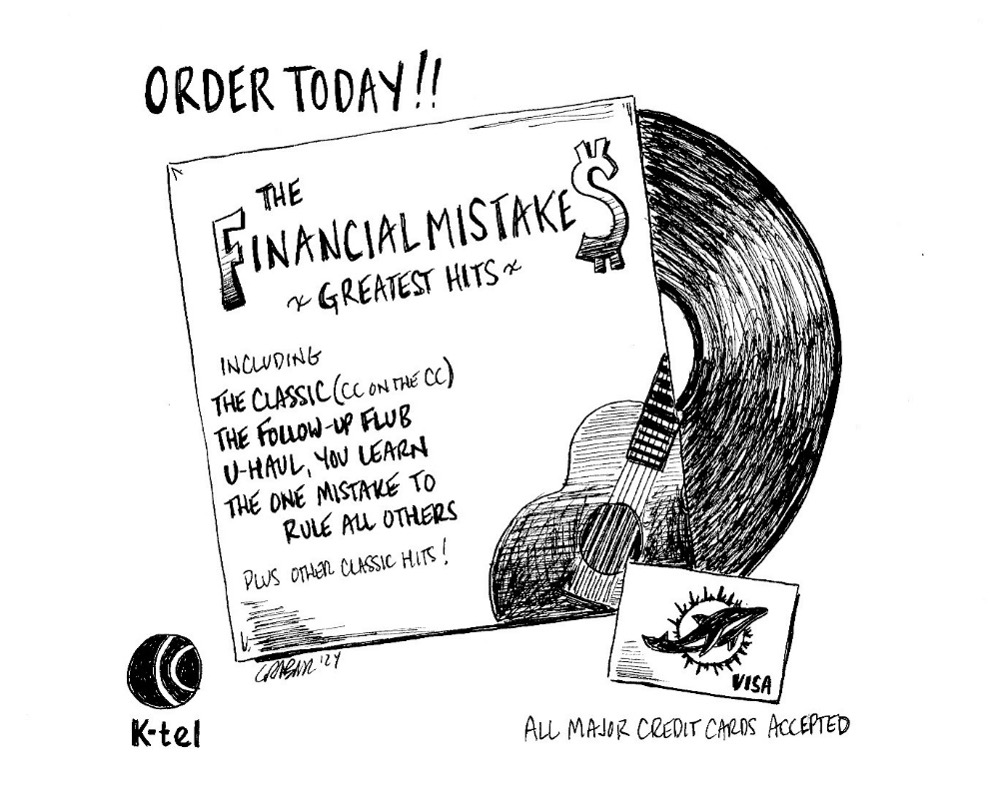

Learning from Financial Mistakes

Recently I’ve been running into “top financial mistakes” lists in the form of articles, social media posts, news stories, etc. I imagine this has something to do with my internet browsing and cookies, even though I haven’t been purposefully reading up on that exact topic. Maybe the www is trying to tell me something.

Whether it’s that or just a financially reflective time of year, it got me thinking about my own money mistakes… And then categorizing them by things like avoidable, should have known better, didn’t know better, darn capitalism, etc.

Since this is a just a blog post, I tried to narrow it down to my greatest hits, not necessarily in $$ terms, but also in terms of the impact on my future decisions and my financial journey in general.

The Classic: signing up for the CC on the CC (credit card on the college campus).

I was barely 18 when I stepped into the student center to get a slice and a coke, but instead found a table with smiling people handing out applications for a Sears Card – along with its $250 limit, 24% interest rate, and a free t-shirt! How could I resist? I should be grateful for this bit of history because this is THE moment when my financial train went rogue, and without it I wouldn’t know the experience of having gotten back on track. Until this moment I was still more of the paper boy, wise with my pennies, turning them into dollars. But very soon after getting my t-shirt and filling out the application I had my card, my first credit card. I quickly maxed it out on whatever an 18 year old could buy at Sears in the mid-80s, got used to the comfort of minimum payments, and as Senator Elizabeth Warren described in the documentary Maxed Out, I “developed a taste for credit.”

My parents couldn’t have prepared me because they didn’t know (no one from previous generations knew) that credit cards were being handed out to us 18-year-olds. It was a relatively new thing at the time. Maybe something in my brain should have realized that getting stuff without paying for it up front was probably not good, but again, I was 18. It’s interesting to note that the CARD Act of 2010 made it illegal for credit cards to be “sold” on college campuses.

The Verdict: I didn’t know better

The Follow-up Flub: getting store credit cards even though I already had a Visa.

After a few years of practice with my Sears card, I graduated to my first real credit card, a nice Visa with a Miami Dolphins logo. The biggest mystery today is wondering how I was ever a Miami Dolphins fan. I could use that card anywhere, and it wasn’t (always) maxed out, so why did I have to get cards from Macy’s, Eddie Bauer, etc.? Oh, this one is pretty much on me. By that time, I had some idea of the impact of paying interest, but I was a consumer peacock, flashing those cards in place of feathers. I bought stuff, and I enjoyed doing so with specific cards for various stores and their 24% interest rates.

The Verdict: should have known better and darn capitalism

U-Haul, You Learn: this one still annoys me.

I was moving from a studio apartment in Connecticut to a one-bedroom in Tennessee, and I decided to rent a small U-Haul truck for the job. The truck wasn’t the only small thing involved as it cost a small fortune for this rental. Where do I begin with how foolish a (financial) move this was? It was 30 years ago, and I am still stinging from the nearly $1,500 I spent including gas. Why was it silly? My belongings at that time were probably worth $500 at most, keepsakes could have fit easily into my Subaru wagon, and I’m sure I could have replaced that crappy desk lamp for a few bucks at Goodwill. I remember clearly that I simply did not analyze the cost or the alternatives. I was single-minded and focused on the move and lost the good sense that had recently led me to stop buying new cars (and to getting the old Subaru which, ironically was a really well spent $1,500). The U-Haul $1,500 was a ton of money for me at that time – too much money to spend so frivolously. How did I do it? Yep, Miami Dolphins Visa.

The Verdict: avoidable, I absolutely should have known better

The One Mistake to Rule All Others: not understanding opportunity cost (a top argument for requiring personal financial education in school).

I can add plenty more mistakes of various financial impact to this list (see this post about cars), and they all matter in some way. But what matters more is what ties them all together – opportunity cost.

My credit card adventures cost me hundreds in interest and thousands in overspending. Buying cars that were out of my reach but nevertheless came to me thanks to creative financing cost me thousands. Unnecessary U-Hauling cost $1,500 for one trip.

So what?

Stage one of “so what” was when I came to grips with the amount of money I recklessly spent over the years, and that was an important stage loaded with critical realizations.

Stage two, however, is where my increasing financial literacy made me begin to connect with not only what I spent, but also, and more importantly, what I could have done with that money.

Stage three, let’s say current day, is when I look at my expected retirement age and lifestyle and realize the impact of those decisions on today’s choices.

stage one + stage two + stage three = understanding opportunity cost.

Yes, that concept which in my first college economics course seemed so boring when presented in the mechanical terms of production possibilities curves, but when applied to personal finance is not boring and drives home the consequences of living beyond our means.

Decades of experience teaching OC in elective courses and clubs tells me that it does sink in, students get it, and it makes a difference.

The Verdict: I really didn’t know better. It’s not natural for humans to think about our future self, especially at 20 years old.

———-

So, come on Maine, how about we take this tool which covers choice, consequence, future self, and financial wellness, and cement it into our school curriculums. I don’t know that it would have protected me 100% from unfortunate financial choices, but even a fraction of that protection would have gone a long way.

If you’ve made or are making these mistakes, no judgement here, just a chance to reflect and/or chart a new course. Despite the costs involved, I can’t say that I regret these decisions as they led to changes and led to me wanting to share and hopefully help others on their financial journey.

Teaching is Sharing and Sharing is Teaching

In the 20 or years that I have taught and talked personal finance, I have found no better tool than sharing my mistakes with students. Is it impactful when a successful or wealthy person shares their tips? Yes. But experience has shown me that it’s even more impactful to talk about what went wrong, what was learned, and what was lost. (I’ve been told that) It feels more like teaching, rather than preaching.

Stories are emotional, emotion prints memory, and those memories can have a profound effect on our students.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.