Is it principal or principle, and which is the one that has to do with money?

Once upon a time, in a high school far enough away, I taught a full-year economics course. And in that course, I often referred to classic schools of thought and, of course, to Adam Smith, philosopher, economist, and the fellow generally considered to be the Father of Capitalism. I enjoyed playing devil’s advocate and provoking students to analyze U.S. economic policy by asking “What would Adam Smith say?” I find his invisible hand theory fascinating to look at through the lens of 21st century economic realities and the evolution of global markets.

Fast forward to the end of one school year, final exam time, and I was excited to see a student’s (let’s call him, JT) analysis of whether our economy was truly a free market system. As he dove into his argument he referenced the Father of Capitalism, Atom Smith. Atom. Not Adam. I assumed it was a typo, it gave me a chuckle, and I moved on…on to see all references to AS were Atom-ic.

It was a good essay, and I did not take off a single point for the Adam/Atom issue. But I had to ask, and I had to wonder if or how many times I had referred to AS in writing during the year. I certainly wrote his name on the board, didn’t I?

So, I asked, “Atom Smith?”

“Well, I honestly didn’t think about it much,” JT replied. “It’s just that all year long I had this image of Smith as sort of an economics superhero, and from that I drew Atom as his name, rather than Adam.”

Did not see that coming. I remember thinking and wondering how many concepts, terms, or people might have been slightly and/or humorously misinterpreted by my students when I got on an economics roll. Which brings me to a favorite line from a favorite character from The Princess Bride.

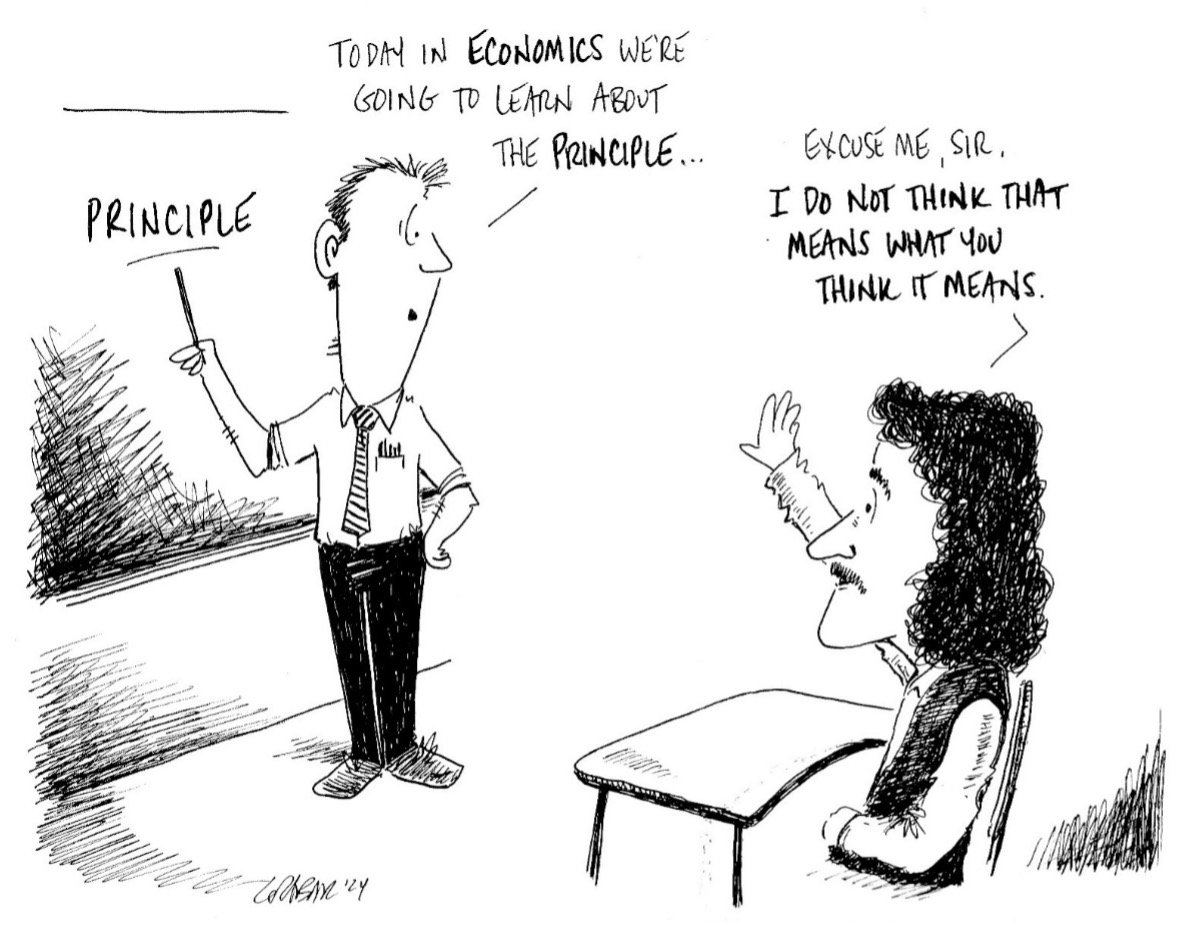

“I Do Not Think That Means What You Think It Means”

That’s what Inigo Montoya says to Vizzini after he keeps taking liberties with the word, “inconceivable”.

I heard it used the other day to (hyperbolically) describe potential economic policy moves by The Fed, and it made me think about the many financial terms and concepts that are often misunderstood or misused. Here are just a few:

Principal and Principle

In school we learn to respect the top authority, the principal. In finance, our principal is the initial amount of money borrowed or invested. And principle is the foundation of a concept, truth, or argument.

Let’s give this a try:

The principal, while covering a class for an absent economics teacher, instructed the class that the principle of safe investing is to protect your principal.

APR and APY

APR = Annual Percentage Rate, the declared or stated rate of interest for an investment or a loan, can also include fees.

APY = Annual Percentage Yield, the actual amount of interest earned (or paid) when including the effect of compounding.

You might see a CD with an APR of 4%, but it also lists an APY of 4.07%. Interest compounded (monthly in this case) attaches to and grows the principal, so at the end of a year, you’ve earned more than 4%. See the link at the end of the post for a great APR to APY calculator.

The Federal Reserve Bank and The U.S. Treasury

The Fed is the nation’s bank and the bank of banks. It was created by Congress in 1913, and its principal function is to manage the nation’s money supply to maintain stable inflation and employment. Jerome Powell is the current Chairman.

The Treasury was created by Congress in 1789 to manage the nation’s money and pay its bills. The Treasury prints money through its Bureau of Engraving and Printing and produces coins through the U.S. Mint. Janet Yellen is the current Secretary.

Although it’s not easy to define exactly what the Fed is or isn’t, it is easy to clarify this common misconception – the Fed does not print money, the Treasury does (it is true that the Fed’s actions can directly lead to the Treasury printing money, but the Fed itself does not print money).

401(k) and 403(b)

While both are tax-advantaged employee retirement accounts, they differ when it comes to participation and investment options. Eligibility is straightforward: 401(k)s are for employees of for-profit companies while 403(b)s are for employees of non-profit institutions. As for the investing part, 403(b)s can invest in annuities and mutual funds while 401(k)s can offer additional opportunities such as bonds, individual stocks, company stock, and ETFs (What’s an ETF? Read on…).

Mutual Funds and ETFs (Exchange Traded Funds)

These are both widely used options for investors to diversify their stock market holdings. The main differences lie in the details of how they are managed and traded.

Mutual Funds are actively managed, and trades can be made only at the end of each day. There can be a performance benefit from active management, but there are fees that come along with that.

ETFs are often passively managed and shares in the funds can be traded like stocks. ETFs often track an index or an investment sector. ETF investors like the flexibility of being able to trade shares during the day, just as they can with individual stocks.

The differences between the two are not as distinct as they once were, but each still has its niche in the world of stock market investing.

ATM Cards and Debit Cards

ATM cards allow access to an account only through ATM machines.

Debit cards allow access to accounts through ATM machines and through point-of-sale transactions, just like a credit card. Debit cards with the Visa and/or Mastercard logo are processing your purchases on the same digital money highway where all the credit cards drive. So, stay in your lane!

And, yes, ATM cards still exist. Some banks have done away with them, but they are around at most banks if you ask.

***

English is tough enough on its own, with an endless number of confusing words, homonyms, idioms, Adams, and atoms. When combined with the huge and ever-expanding glossary from the financial world, it can seem impossible to keep up. So, let’s keep learning little by little, word by word. To not do so would be… Inconceivable!

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.