From Paper Boy to Plastic Man

When I was in high school, the closest thing we had to a personal finance course was home economics. While I don’t fully trust my memory, I can safely say that some aspects of what we now call personal finance were a part of that course – opening a bank account, balancing a checkbook, tracking expenses, food shopping and meal planning, etc. But in my school (anecdotally speaking in most schools I’ve heard about), it was a course that the girls took while most of the boys took “shop”. That and the fact that these courses gradually disappeared from many schools are topics for another day.

Whether its home economics or personal finance, it is, ultimately, personal. Our unique experiences are what separate the topic from the bigger world of finance – the one with international trade, currency fluctuations, PE ratios for stocks, bond markets, and other dizzying concepts.

Our story is the one that matters.

So, I’ll tell you mine (well, just part one for now) if you’ll promise to at least think about yours. It would be even better if you would write yours. I found the experience enlightening, liberating, emotional, and satisfying.

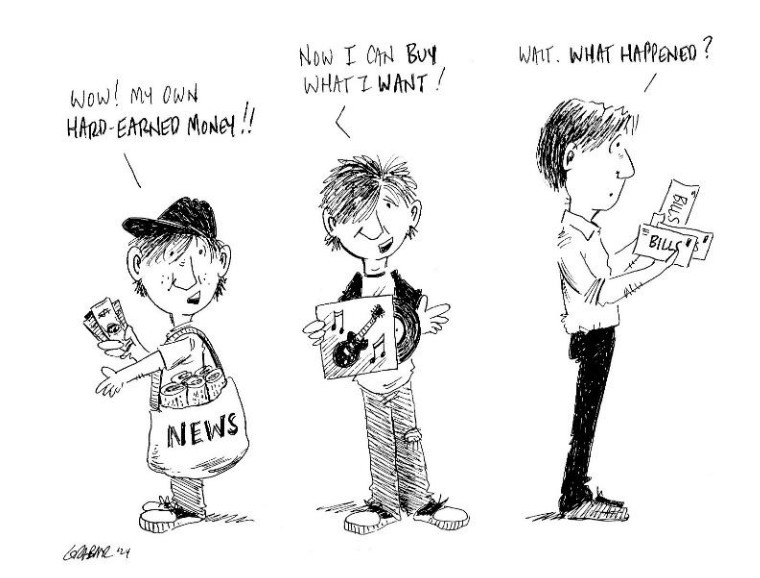

It was 1974, and I was the youngest paper boy in the state. Every morning, I hit the streets of Derby, Connecticut, sometimes in the dark, sometimes on my bike, sometimes in the car with mom, but most often alone. I made my rounds, placing the rolled up New Haven Register papers inside screen doors or dropping them in mailboxes. I delivered to houses, pizza places, and law offices in brick buildings with huge wooden doors. Once every two weeks, in the afternoons, I made my collections, took home the 20 or 30 envelopes, and laid them on the kitchen table. I reconciled my receipts, calculated what I owed the company, counted my profits, and figured how much I could put into my savings account. I was nine years old. When I was 12, I would turn much of those savings into my first major purchase – a Radio Shack stereo, along with a few of the best rock albums of 1977 including Point of No Return, Book of Dreams, and The Grand Illusion. What a system: work, earn, save, spend, repeat.

On the mornings when mom drove me – either because of weather or because I was nine – we somehow found time to stop at Dunkin’ Donuts. Mom got a black coffee and we both got double chocolate donuts. I remember one morning, after I’d had the paper route for a few months, when I paid. I couldn’t get the money out of my little change pocket fast enough. I still choose the double chocolate donut when I go to The Dunkin’, and I think of those mornings with mom.

I got my first credit card at 20, and by the time I was 25, I had at least seven or eight, each carrying balances of several hundred dollars or more. The system had changed. Work, earn, spend more than you earn, pay interest, work even more to pay for it all, repeat. By 27, I was caught in a dismal cycle. My job paid well, but I hated it. I needed that job because my obligations had grown along with – no, grown faster than – my income, and I couldn’t match it doing something I wanted to do. I was on a treadmill that was outrunning me, and with each day I saw that my job was sometimes contributing to others’ treadmills. I soon found myself looking beyond that misery and reaching for the philosophical. What happened to the paper boy? What kind of system is this? How do I get out?

Edge of your seat, I know. Spoiler alert – I did climb out of that mess and have gradually found firmer financial ground. However, that rough start was expensive, and I’m still paying in terms of opportunity cost. Let’s just say that my expected retirement age went up while my lifestyle options while retired…yep, they’ve gone the other direction.

Not only do our stories matter, but they are also incredibly effective when teaching personal finance. In my experience, students are more likely to listen to and put into practice financial education when the messages have a face and feel real. It’s no different than that history teacher (I think most of us had one) who used stories to make past events and people relatable and interesting. This is the core reason why someone like Dave Ramsey has built a “money-talk” empire – he teaches from vulnerability, failure, and rebuilding.

We want our students to remember our lessons and messages. Stories and humor are emotional. Emotion prints memory. You can use your personal lessons and/or help students connect with and tell their own stories about money. This can highlight their experience so far or can help them explore what they want their personal finance story to be. I used to add an alternative project or supplement to writing a personal finance story – a personal finance road map – where students could make a poster-like project showing stages of their life and where and how money fits into their life experiences, goals, and dreams.

I know a few people who seem to have never made mistakes with money. I know a few more who have enough wiggle room to make mistakes with a capital $ on the end. However, most people I know (and, statistically speaking, the vast majority of Americans), have tripped and fallen and continue to stumble on their personal financial journey.

This former financially savvy paper boy turned wallet-full-of-plastic guy got to work on getting it right when I faced up to the reality of where my money behavior was taking me. The biggest steps I made along the way came when I dug into and learned from my mistakes, when I understood my story.

I hope you’ll dig into yours.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.