Education and Financial Aid: Life in the FAFSA Lane

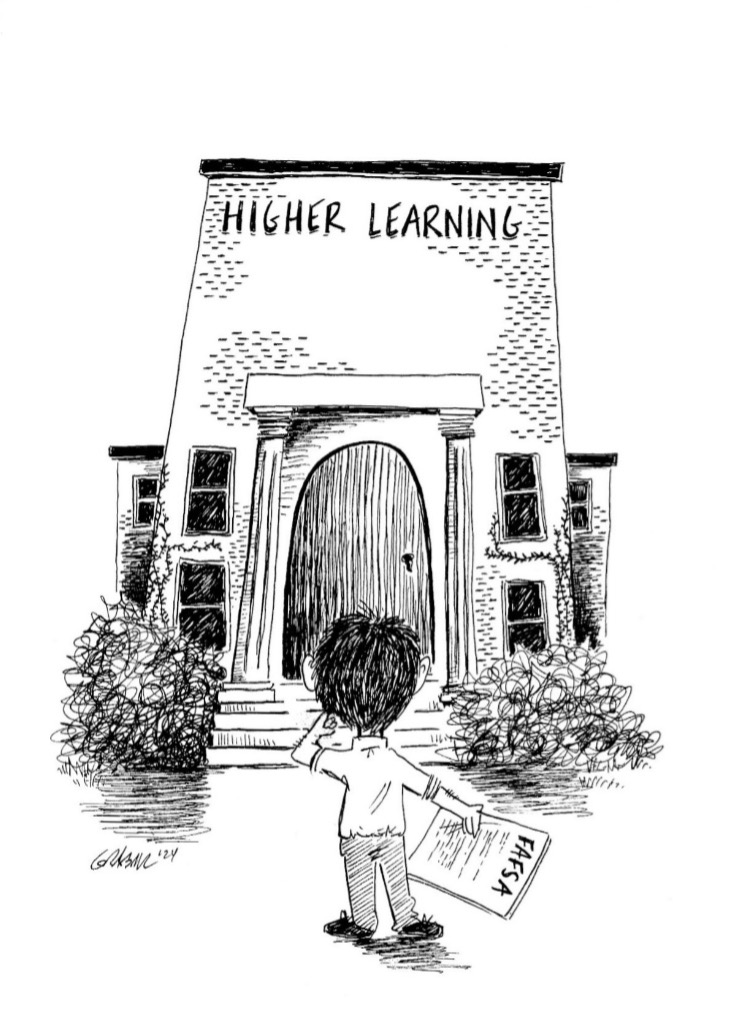

What season is it? Ask most folks and of course, they will say fall, but ask high school seniors, their parents, and counselors, and they might just come back with FAFSA season. Once again, it’s time for a critical part of the higher education access process—paying for it.

FAFSA: Free Application for Federal Student Aid

It’s been quite a year or so for the FAFSA as it underwent a thorough overhaul, a past-due winter release in January, glitches and errors, subsequent months of repair, and even an investigation by the GAO (US Government Accountability Office).

The goals of the overhaul were to make the process much easier and to make sure that federal aid was available to those who need it.

The Latest

Fortunately, FAME’s College Access Team is here, focusing on helping families through the FAFSA process as part of the bigger picture of accessing and affording education after high school. And leading that team is Mila Tappan, who I’ve asked to bring us up to date on FAFSA ’25-’26.

#1. What are some of the biggest FAFSA myths you would like to debunk?

The FAFSA has gotten so much easier to complete. Most people can complete their section of the FAFSA in less than 15 minutes! If people need additional assistance, FAME offers free help via Zoom.

I’d also like to debunk the myth that it isn’t worth the effort to file the FAFSA. The FAFSA is free, and this one application opens access to federal, state, and often institutional financial aid eligibility, including grants and scholarships that don’t have to be repaid. If students need to borrow any loans, federal student loans are best but require borrowers to file the FAFSA. Additionally, the FAFSA is required to access tuition-free community college and is also required for many scholarships.

#2. The money question: Where do things stand with updates to the FAFSA?

There is no doubt that the rollout of the updated FAFSA last year was rough. However, most issues have been resolved and any remaining glitches are being actively worked on. The 2025-2026 FAFSA will be available to everyone by December 1, 2024. From October 1 through December 1, extensive beta testing is being conducted. We are optimistic that when the FAFSA is released to everyone by December 1, it will work as intended, be glitch-free, and fully functioning.

#3. Even though last year’s rollout of the FAFSA updates was clunky, to say the least, were you able to still notice the changes to the FAFSA? Were there some obvious improvements?

Yes absolutely! Even in the early days of the rollout, many families completed the FAFSA with relative ease. The updated FAFSA has fewer questions and pulls in required information from other sources when possible. For example, most individuals will no longer have to manually enter income information. Assuming people provide consent (a requirement), tax information will automatically be pulled over from the IRS. Those who aren’t required to file taxes are no longer required to report their income. Additionally, most people who received a means-tested benefit, like MaineCare, or who earn less than $60,000 annually will no longer have to provide any asset information. These changes make the FAFSA easier to complete and ensure that the tax information provided is accurate.

#4. If all things FAFSA was not your job, what sources would you use for information and support when looking for FAFSA help or help with financial aid in general?

I would encourage everyone to visit the FAMEmaine.com website. There they will find information on the steps to get ready and file the FAFSA and an extensive list of FAQs. They will also find resources including our PAY: Tip to Afford Higher Education booklet, our Get Ready to File the FAFSA checklists, Federal Student Aid account (FSA ID) tracking worksheets, and more.

I would also love for people to join our texting and/or e-mail list which can be done at FAMEmaine.com/join. We won’t inundate people with communications but will provide timely updates on the FAFSA and the entire financial aid process, including what happens after the FAFSA is filed. We are also active on social media and have a Facebook group for parents and caregivers called Paying for College for ME.

Outside of FAME, a good source for information is Federal Student Aid. Their website is StudentAid.gov, which is where people go to create their Federal Student Aid account and file the FAFSA. They also have good social media content.

#5. Other than filing the FAFSA, what advice do you give students/families on the topic of affording education after high school?

One of the best ways to make higher education more affordable is to include affordability as a criterion when researching and building a list of schools. We want to be sure that students have options and that the schools on the list are a good fit academically, socially, geographically, and size-wise but also consider affordability. A great place to get started is by using the Big Future College Search tool. This site allows students to search for schools based on various criteria including affordability.

It is also important for students and families to talk about expectations related to paying for higher education. Too often students and parents have unrealistic expectations of who is paying for what and the amount of money available for higher education. We have a list of conversation starters that can help ensure that students and families are on the same page. Having this conversation before spring of senior year can help make decisions related to college selection easier.

It’s also helpful if students can remain flexible. There are multiple pathways for most students to accomplish their goals. If students can keep their options open and not get their heart set on a particular school early in the process, this will allow them to make more informed decisions. We encourage students to wait until they’ve received and compared all admission and financial aid offers before making a decision. These decisions can be very emotional, but if people wait until all the information is available, they tend to make decisions they are happier with in the coming years.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.