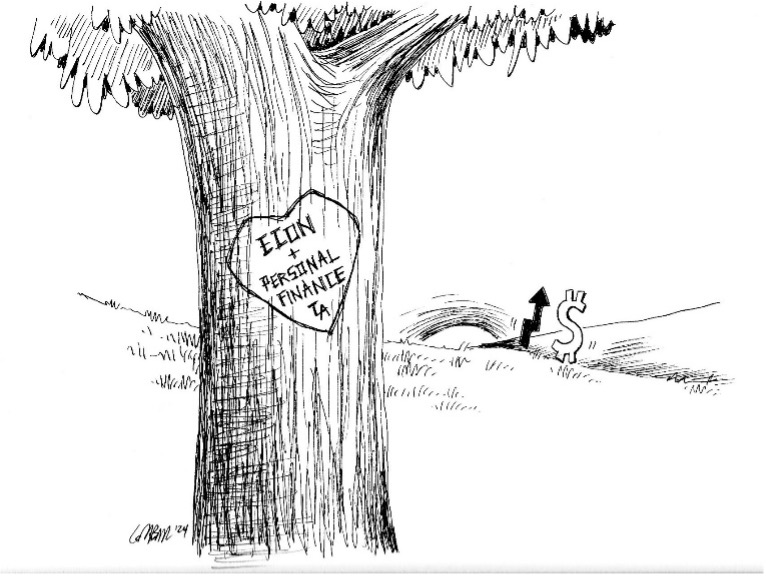

Economics & Personal Finance – A Love Story, Part One

In our economic system – let’s call it Mostly Capitalism – there is no escaping the incredible weight of decision making when it comes to managing our personal finances. We need every possible intellectual asset at our disposal. I recommend using economics as a key tool for you and your students on your personal financial journey.

We’ve been through a lot, econ and me, and although we are in a good place now, it hasn’t always been easy. The stages of my relationship with economics, starting with the most recent:

- Love it, need it, teach it, preach it.

- The “Ah ha-I get it now-this is fascinating” stage. A major turning point thanks to my experience in the Peace Corps and to a graduate refresher course.

- In my 20s there was no econ or personal finance, just credit cards, car loans, and consumption.

- Junior and senior years of college, one professor planted an idea or two.

- Freshman and sophomore years in college…Read on.

Lecture Halls, Production Possibility Curves, and Yawns.

Just a few years ago (hahaha, define … “few”) I majored in economics at Southern Connecticut State University. I chose economics because it was the best way to get a business-related degree without taking a lot of math. Ah, the rationale of a 17-year-old. So, in the fall of that year, I fired up my old orange Subaru and headed off to class, but the start of my economics education was inauspicious at best.

You are probably familiar with this scene: a lecture hall with 150 students for Day One of Econ 101 – Principles of Macroeconomics. Yuck. What followed was 100 weeks (ok, it was only about 12) of sleepy lectures filled with aggregate output curves and the impact of public goods.

The only thing worse than those classes was the textbook – 4.5 pounds of graphs and chapter titles like, Factors of Production and Aggregate Supply & Demand. Absolutely no knock on SCSU or the teachers – it was a function of large classes, a tired yet established way of teaching economics, my age, and the absence of meaning in the abstract theories, numbers, and charts.

Econ 102 followed, which focused on microeconomics and rocked our intellect with production possibilities curves and the price elasticity of widgets. Then came the 200-level courses which were slightly deeper dives delivered in smaller classes.

Halfway through the degree, I was considering a switch to sociology.

But in my junior year I was able to take econ electives, and everything changed. Professor Crakes gets full credit for sparking what would become a foundational topic both in school and in my pursuit of personal financial righteousness.

A Few Years and a Few Credit Cards Later

In post #2 of this blog, I mentioned that during college I stumbled and fumbled with money. Credit cards were easy to get, with monthly minimum payments fooling me into thinking I could afford yet another thing that I didn’t need. It was a time when I wasn’t connected to my personal finances or to economics. Eventually, and fortunately, these two pillars of financial life came together and ever since I’ve included econ in my personal finance classes and in my personal financial life.

In fact, it was while I was teaching economics at a high school in Richmond, Virginia, that everything gelled thanks to a “Macroeconomics Refresher” course at the University of Richmond and another influential teacher. I enrolled to brush up on concepts that I never felt connected with back at the start of college. The instructor was Dr. Gerry Swanson from the University of Arizona.

You might not have heard of Dr. Swanson, but some of you will recognize this name – Ross Perot – the one-time independent presidential candidate (1992) and his 30-minute prime-time infomercials where he lectured American voters on economics. Remember the charts? He used a lot of them, and 16 million people tuned in for the first installment. Well, it turns out that Dr. Swanson was the guy who made those charts. Politics aside, it was fascinating to hear details from that campaign.

But not as fascinating as what he showed us about the economy and how it affected every one of us.

TANSTAAFL, Trade-Off, and Opportunity Cost

Dr. Swanson came in one day wearing a t-shirt with TANSTAAFL printed across the front. We finally asked and he answered by turning around and showing us the full phrase on the back, “There Ain’t No Such Thing As A Free Lunch”. He then led us through an exercise in trade-off and opportunity cost, showing the costs associated with “free” things. The bottom line was that nothing is free, and at the core of every economic choice should be a consideration of opportunity cost (the cost of making a choice).

Around that time and in the years since I realized (and continue to remind myself almost every day) that the key to personal financial behavior lies in this core economics concept.

As we went on to study economic policy, The Federal Reserve Bank, and the national debt, it became clearer than ever that although our government (regardless of party) does not adhere to Econ 101, 102, 202, or 502, individuals should be using econ basics to inform our decisions about money. That pushed me to double down on my efforts to manage my personal economy regardless of the state of our national monetary or fiscal policy.

Sharing the Love

Understanding economics is integral to personal finance and, therefore, to personal finance education. It helps by holding up a mirror to our behavior and by helping us understand the economy, how it swirls around us and affects us, and how we affect it.

Yes, this is about economics. It’s also about the impact and power of good teaching.

We learn in our own ways, and I am sure that since the time of Adam Smith many have learned and enjoyed economics taught the old-fashioned way. However, for me, and maybe for entire generations, those heavy textbooks and even heavier graph-centric lectures did not do the topic justice.

Economics came alive when I was lucky enough to have teachers who made it relevant. They didn’t just explain the nuts and bolts of elasticity of demand, they illuminated the connections to everyday experiences, especially when it came to decision-making and money. Those teachers inspired me to do the same for my students.

To survive and thrive in our system takes more than just managing money and resources. It also takes an understanding of how everything is being managed around us. We might not always like what we see or hear, but being armed with the skills to interpret it is vital.

Next time, I’ll share my thoughts on what I think are some critical economics topics that fit perfectly with personal finance. In the meantime, you can check out this webinar on FAME’s YouTube channel I recorded a few months ago. According to at least one friend it was, “a good listen while driving”.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.