April is Financial Literacy Month; what could that mean for you?

About a year ago we released the first post for this blog, and I’m still here, 15 posts older and more eager than ever to keep the conversation going. In those 15 posts, I touched on economics, the monthly payment mindset, budgeting, financial aid for education, personal finance terminology, insurance, reflection on my own… Uh… Experiences (mistake$), and more.

I’ll call this an accomplishment, but I’ll also note that during the past year the list of topics I still need to write about has grown. Yes, there is much to discuss, much to share, much to learn.

Financial Literacy Month

Despite the fact that it is snowing as I’m blogging, April is back, and in FAME’s world that means, among other things, Financial Literacy Month. It’s a time when organizations, educators, and financial professionals everywhere in the US are promoting the importance of financial capability. Here’s a sample of what’s going on right here in Maine.

Events, initiatives, and resources:

- Educator’s conference: Maine Jump$tart’s 16th Annual Fostering Financial Education in Maine Schools Conference will be held May 8-9 in Portland. This year’s event is unique as the May 8th portion is being brought to us by VISA and the Council for Economic Education, who have put together an incredible day of training and fun including meals and a sunset cruise in Casco Bay. There is still time to register!

- For kids: FAME’s first-ever Design Your Own Dream Money contest is underway. This is for all Maine students in grades 1-6, and submissions will be accepted until April 30.

- Could it be? Personal finance becoming a graduation requirement in Maine? Well, maybe not yet, but efforts are underway during this legislative session to once again bring the conversation forward. The first hearing took place on April 1, 2025; read more about the bill here.

- A FREE summer course for high school students: FAME’s 2025 Personal Finance Summer Institute is happening July 21-25 in Portland, and registration is open.

- More from FAME: Resources to help you celebrate and promote Financial Literacy Month

It’s not just snowflakes falling

I’m not writing in a vacuum; therefore, I can’t go on without acknowledging the stock market-related pain that has been April, so far.

It’s been hard to watch, and depending on where you are on a scale of 20-something to retired, you might not want to watch, at least in the short-run. From an educational perspective, it’s critical to understand the history of stock market movements and the basis for its relative long-term success.

The stock market is ultimately based on the performance of an incredibly wide range of companies that produce and sell everything we consume. Our economy runs like no other, we consume like no others, and as a result, those companies make (and distribute back to stockholders) steady and substantial profits. This fact is, it’s not going to change based on anything that has happened or is likely to happen to our economy in 2025.

Yes, we are in or close to what is known as “correction” territory. However, “Corrections in the stock market are pretty standard fare. There have been 21 declines of 10% or more in the S&P 500 since 1980, with an average intra-year drawdown of 14%,” according to Baird Private Wealth Management. (cnbc.com)

If you are using your investments now or expect to be soon, you might need to consult a professional before taking action. But for most investors most of the time, don’t just do something, stand there! Warren Buffet knows a little about stocks and has been known to offer on-the-money advice. One of his favorite lines comes from a 19th-century poem by Rudyard Kipling; “If you can keep your head when all about you are losing theirs… If you can wait and not be tired by waiting… If you can think — and not make thoughts your aim… If you can trust yourself when all men doubt you… Yours is the Earth and everything that’s in it.”

Back to Financial Literacy Month

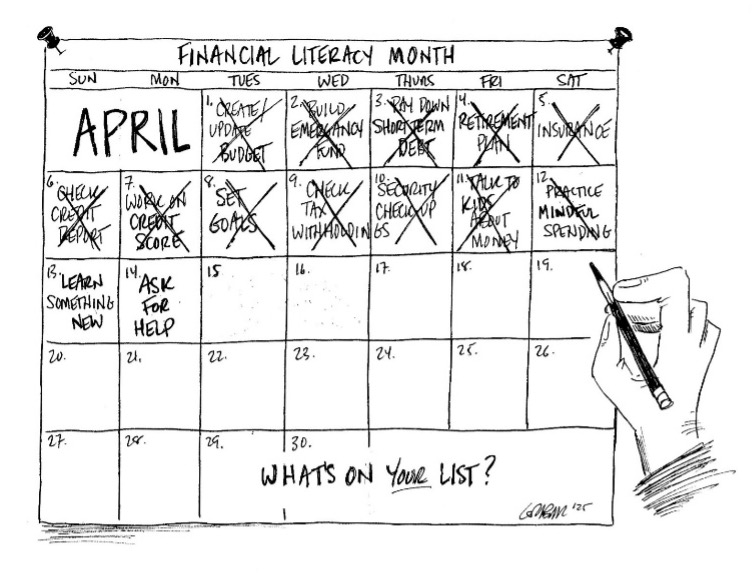

Once again, money lists are everywhere, and I do like a good list. I’m referring to the personal finance type – things to do, think about, start, finish, check on, cut back, increase, and just about any other verb you can connect to managing money.

I’ve perused these for weeks, boiled it all down, and have come up with my own – a Top 14 money-related menu for Financial Literacy Month.

Why 14? Because I don’t think I’ve ever seen a Top 14 list. Or we can consider it inflation’s effect on Letterman.

Top 14 Personal Finance Items Checklist for Financial Literacy Month 2025 (in no particular order, although I will highlight my personal Top 3 for 2025)

- Create/Update Budget

- Build/Reinforce Emergency Fund

- Payoff/Pay Down Short-Term Debt

- Prioritize Retirement Plan

- Insurance Check-up

- Boost Automated Saving/Investing

- Increase Education Savings

- Check Your Credit Report

- Work on Your Credit Score

- Set Goals

- Check Your Tax Withholdings

- Develop Buyer’s Remorse – BEFORE Buying!

- Internet/Technology & Financial Security Checkup

- Talk with Children about Money

An interesting thing I’ve noticed – when you work on one of these, others are often affected, like dominoes falling in the right direction. For example, by checking on insurance, you might change your deductibles, save $120/year, and redirect that money into building an emergency fund or into boosting savings. By paying off debt you can increase your credit score, which has benefits ranging from lower mortgage interest to better car insurance rates. So even if you can only directly work on one…

And the list(s) go on and on… Like I said in that first post a year ago (yes, I say it a lot), our financial system is complicated, slippery, and difficult to navigate. It takes constant vigilance and learning to give order to all things money.

So, think about what Financial Literacy Month means to you? Attack a piece from that list or from others’ lists and give your future self the gift of good money decisions today.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.