Am I paying too much for insurance?

There is no quick or definite answer to that question. But there are ways to analyze coverage versus cost and feel you are getting what you need at a price you can stomach.

***

“The car won’t start,” texted my wife early on a recent Sunday morning, while I was 1,000 miles away visiting my mom.

She sent me a video, and I brilliantly concluded that the battery was dead. After a few minutes of trying to determine why the battery died, we turned our attention to figuring out what to do about it. It took me a minute to remember that we had AAA. For seven years living in Spain, AAA was not a part of my life, but as soon as I moved back to Maine and got a car, I reupped as that service had towed me, jumpstarted me, and even pulled a loved one out a ditch.

And while AAA is not necessarily marketed as insurance, for me it is and a darn good-value-insurance at that. That got me thinking…

Issue #1: Why Do We Buy Insurance?

Let’s put aside all things related to legally required insurance and focus on our choices. I cannot help anyone into the insurance happy zone as it lives in the same place in our hearts as taxes. What I hope to do is offer a path to peace of mind, to know you are doing the best you can with your insurance costs and choices.

The purpose of insurance is protection against loss; partially restoring our financial position. Contrary to mass-marketing messages and popular belief, insurance is not designed to make us 100% whole after a loss. So, know that going in – we will pay for insurance protection and still have to pay more when we use the insurance.

And, not only have the upfront premiums gone up, the portion we pay in the form of co-pay, co-insurance, and deductibles, has also ballooned.

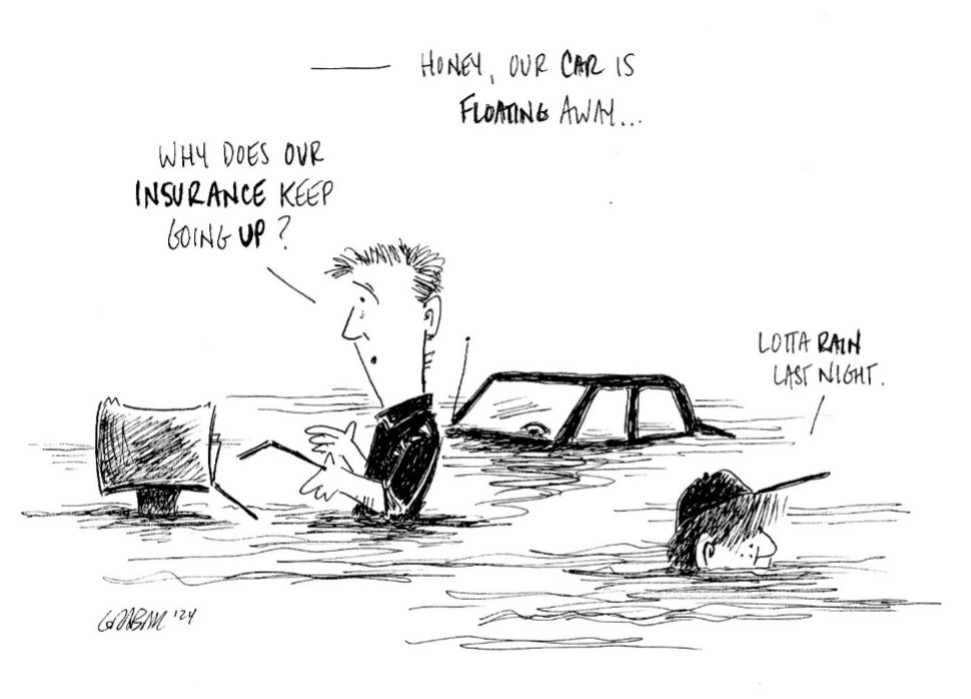

There are plenty of factors blamed when discussing why the above is true, and I can’t tackle them here. What I can say is 1) insurance companies are in business to make a profit for their shareholders/owners/policyholders 2) losses from natural disasters have increased, and perhaps more importantly, are expected to increase even more with climate change 3) there are more people living in areas affected by these disasters 4) the costs of home repair, car parts, medical care, and liability activity have gone up as fast or faster than almost everything else in our lives.

Deal or No Deal?

It is tricky to determine if your insurance is a fair deal. I say fair because Economists Rule #7 (yes, a nod to my favorite writer, the late Robert Parker) states that you can’t really expect a good deal out of any transaction. If someone is getting a good deal, that means someone else is getting a bad deal. Generally speaking, insurance companies, with their legions of actuaries and analysts, are probably not getting a bad deal when they do business with you, so better to think in terms of fair.

It comes down to premium (cost) versus potential benefit. Potential because we hope to never use our insurance. A few notes:

- This is subjective. We don’t all value the same things in the same way. This is affected by our habits, experiences, and cultural values. Ultimately, insurance decisions are personal.

- These are generic examples, aiming at what would be realistic for most folks.

- Circumstances that affect insurance costs are sometimes out of our control.

- It’s a moving target. Stay informed, review, and evaluate often.

I’ll offer analysis on a few common types of insurance with ballpark cost/benefit numbers. Thinking about insurance in this way is transferrable to other kinds of insurance and can be a great tool in your personal finance toolbox.

Term Life Insurance: $250/year for 20 years of a $200,000 death benefit for a relatively healthy 40-year-old. Peace of mind. A financial cushion for those who depend on you. A bargain.

Term Life Insurance: A $10,000 “burial” policy for someone over 70, at a cost of $600/year. While coming up with burial costs is a significant financial and emotional burden, $600/year to protect $10,000 is not a strong financial move. In this case it might be better to self-insure, put that $600/year into an investment, and try to save extra for when it’s needed. This is a case of one size does not fit all, and you have to do what feels right.

Mobile Phone Insurance: $200/year premium plus a $100 deductible in case of loss, all to protect a $750 phone. This is a bad deal for the consumer. It’s very little potential coverage for the cost. Put that $200 you would pay for the insurance plus the $100 deductible in your emergency fund and treat your phone like it’s worth $1000.

Homeowner’s Insurance: $1,200/year to insure a $500,000 home, plus $300,000 in liability protection, all with a $1,000 deductible. Sign me up every day. Yes, prices are going up, but the ratio of cost/potential benefit is good for the insured. This is what insurance is meant to do. If you paid these rates for 25 years, it would cost $30,000 plus lost investment opportunities. A lot, yes, but nothing compared to the cost of replacing, repairing, or rebuilding a home, or paying legal fees when a clumsy neighbor trips over your tulips.

Product Insurance: I recently purchased a $30 fan at a big retailer. They offered additional insurance/warranty for $9.99 for two years of coverage. Hmmm… How do I say this clearly? It’s awful! The insurance costs a full 30% of the price of the product! And many credit cards offer an additional warranty automatically on purchases made with that card. Maybe you are saying, “Yeah, there is NO way I would buy that.” But keep in mind, they do not continue to offer it because no one is buying. A lot of folks are, and it’s incredibly profitable for the company, and the way it’s sold at checkout makes it easy to “include it in the cart” without really thinking about it. Buyer beware.

AAA Roadside Assistance: It’s how this conversation started, so I’ll finish here. My AAA plan is about $100/year. I hope it’s $100 wasted. However, chances are I will use it, just like I had to last week. There are specific benefits that can be measured against the annual AAA fee, and they can be substantial (calling for assistance, towing, jumpstart, etc.) but with this insurance it’s also about the uncountable costs incurred when you or a loved one is stuck on the side of the road in the middle of two things – the night and nowhere.

You can get affordable roadside coverage through your auto insurance as well but be careful to get the full details on what is covered. In my experience, some of those car insurance add-ons are not comprehensive.

Other Insurances: I apply the same process to all my insurance decisions. Cost analysis first, then add the uncountable.

Cost/potential benefit + intangibles = is it worth it?

Still Not Sure?

If you are facing a big increase in your insurance premiums or trying to decide whether to buy a certain insurance, shopping around and evaluating coverages and deductibles are the first steps to take. I also recommend finding a local agent to help sort through the details and shop for the best coverage/price combination.

Insurance is a necessary piece of our overall financial wellness. It’s not going away, and it’s not going to get cheaper or easier to manage. While I can’t tell anyone what kind or how much insurance they need, I can help (and I am happy to, just send me an email) with the analysis and how to evaluate the options.

About the Author:

Steve has worked on financial literacy efforts in Maine since 2004, and in July 2023 he started at FAME as a Financial Education Programs Specialist. He has a B.S. in economics from Southern Connecticut State University, an MBA from the University of Hartford, and he has served as a U.S. Peace Corps Volunteer.

In the fall of 2003, he started a 20-year connection to the Waynflete School in Portland, where he taught math and personal finance, advised middle and upper school students, and coached baseball. Steve worked with students to create the Finance Club and an award-winning LifeSmarts team (Nationals 2013, 2014, and 2015). In 2011, Steve coached a Waynflete team to victory in the Boston Federal Reserve Economics Cup Challenge.

Steve was named Maine Jump$tart Financial Educator of the Year for 2012, was the keynote speaker at the Maine Jump$tart Annual Teacher Conferences in 2015 and 2023, and was Maine Jump$tart’s training coordinator from 2017 to 2023.

Steve and his family moved to Seville, Spain in July 2016 where he taught English and business English and learned many new personal finance lessons. He now lives in Portland with his wife and their son.