Enter the amount you want to borrow from Maine Loan for the upcoming year to help you decide which repayment option you would like to choose. As you make your decision, keep in mind potential borrowing needs for future years.

When you enter the amount of the loan, the calculator will tell you what your monthly student loan payments will be and how much the loan will cost you over your entire repayment term.

The Maine Loan currently has a 0% up-front/origination fee. This calculator is for estimation and comparison only. Rates include a 0.25% reduction for autopay.4

| Maine Loan Amount Borrowed:

|

|

|

|

Immediate Repayment |

Interest-Only Repayment |

Deferred Repayment |

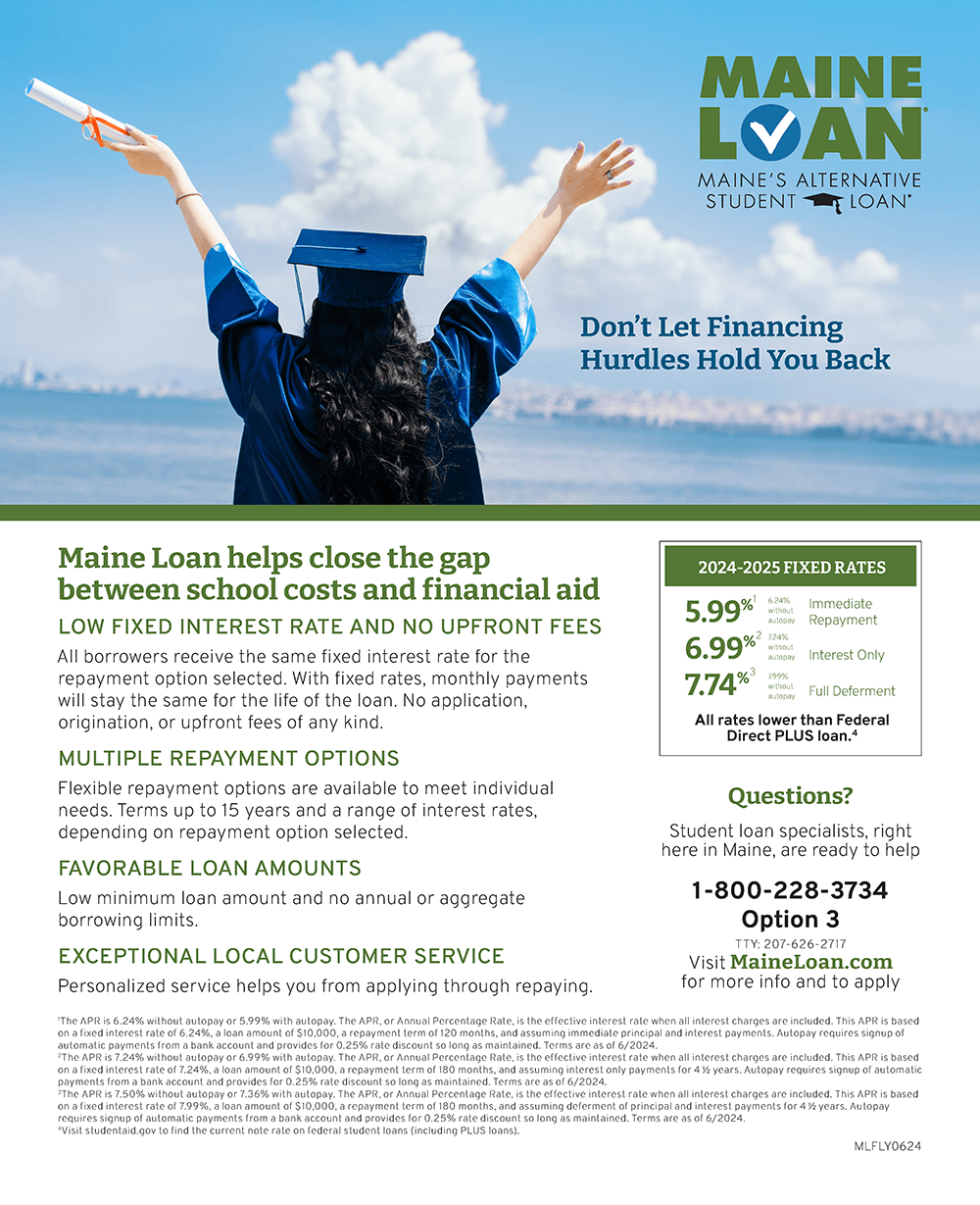

| Interest Rate |

5.99%1 |

6.99%2 |

7.74%3 |

| Guarantee Fee |

0% |

0% |

0% |

| Loan Term (months) |

120 months |

180 months |

180 months |

| Your monthly payment while in school and during six-month grace period |

|

|

|

| Your monthly payment after school/beyond grace period |

|

|

|

| The total cost of the loan will be |

|

|

|

Note: Interest-only payments can vary monthly based on the number of days between interest payments.

Immediate Repayment

Begin regular payments of principal and interest within 30 to 60 days of disbursement.

Interest-Only Repayment

Defer principal payments while enrolled at least half time. Interest-only payments are required.

Deferred Repayment

Defer principal and interest payments while enrolled in a degree-granting school at least half time. Unpaid interest will be capitalized when the loan enters repayment.

*Your student loan grace period is a set amount of time after you graduate, leave school, or drop below half-time enrollment before you must begin repayment on your loan. For most student loans, including the Maine Loans, the grace period is six months, but in some instances, a grace period could be longer.

1 The APR is 6.24% without autopay or 5.99% with autopay. The APR, or Annual Percentage Rate, is the effective interest rate when all interest charges are included. This APR is based on a fixed interest rate of 5.99%, a loan amount of $10,000, a repayment term of 120 months, and assuming immediate principal and interest payments. Terms are as of June 2024.

2 The APR is 7.24% without autopay or 6.99% with autopay. The APR, or Annual Percentage Rate, is the effective interest rate when all interest charges are included. This APR is based on a fixed interest rate of 6.99%, a loan amount of $10,000, a repayment term of 180 months, and assuming interest-only payments for 4 1/2 years. Terms are as of June 2024.

3 The APR is 7.50% without autopay or 7.36% with autopay. The APR, or Annual Percentage Rate, is the effective interest rate when all interest charges are included. This APR is based on a fixed interest rate of 7.99%, a loan amount of $10,000, a repayment term of 180 months, and assuming deferment of principal and interest payments for 4 1/2 years. Terms are as of June 2024.

4 An interest rate reduction of 0.25% is available to borrowers. To qualify, borrowers need to arrange with the loan servicer to have their payments automatically withdrawn from a checking or savings account. This interest rate reduction will remain on the account unless the loans are in a status which does not require payments, or automatic deduction is revoked by the borrower or suspended by the loan servicer according to the insufficient funds policy in effect when the agreement is signed. Upon request, FAME will provide a projection of the percentage of borrowers who are likely to benefit from this interest rate reduction.